Accounting Rate of Return ARR Formula Examples

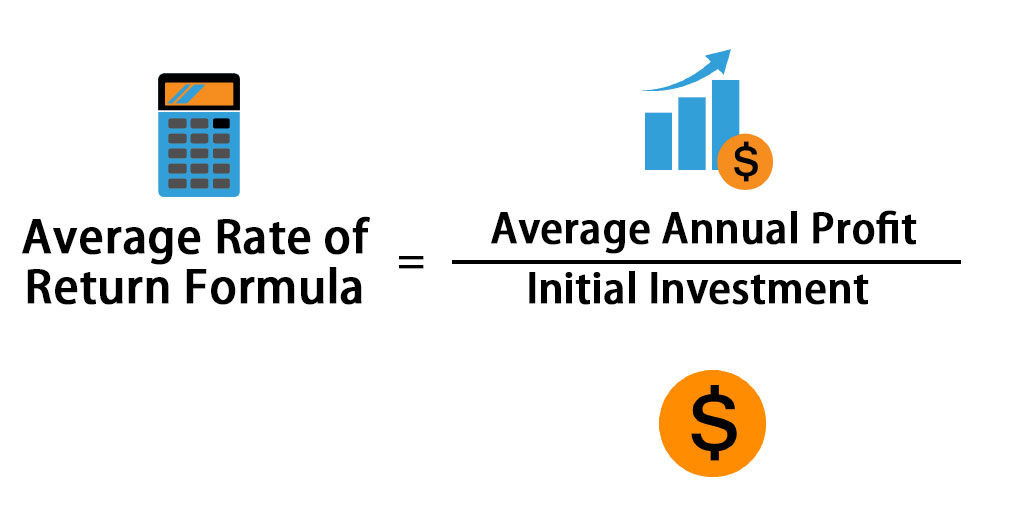

It also allows managers and investors to calculate the potential profitability of a project or asset. It is a very handy decision-making tool due to the fact that it is so easy to use for financial planning. The ARR formula calculates the return or ratio that may be anticipated during the lifespan of a project or asset by dividing the asset’s average income by the company’s initial expenditure. The present value of money and cash flows, which are often crucial components of sustaining a firm, are not taken into account by ARR. The accounting rate of return, also known as the return on investment, gives the annual accounting profits arising from an investment as a percentage of the investment made. The accounting rate of return (ARR) formula divides an asset’s average revenue by the company’s initial investment to derive the ratio or return generated from the net income of the proposed capital investment.

Ignores the time-value of money

Accounting Rate of Return, shortly referred to as ARR, is the percentage of average accounting profit earned from an investment in comparison with the average accounting value of investment over the period. Below is the estimated cost of the project, along with revenue and annual expenses. Depreciation is a direct cost that reduces the value of an asset or profit of a company.

Create a Free Account and Ask Any Financial Question

The company expects to increase the revenue of $ 3M per year from this equipment, it also increases the operating expense of around $ 500,000 per year (exclude depreciation). However, the formula doesn’t take the cash flow of a project or investment into account. It should therefore always be used alongside other metrics to get a more rounded and accurate picture. The how to create a business succession plan (ARR) is an indicator of the performance or profitability of an investment. The denominator in the formula is the amount of investment initially required to purchase the asset. If an old asset is replaced with a new one, the amount of initial investment would be reduced by any proceeds realized from the sale of old equipment.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

- The operating expenses of the equipment other than depreciation would be $3,000 per year.

- Like any other financial indicator, ARR has its advantages and disadvantages.

- Next we need to convert this profit for the whole project into an average figure, so dividing by five years gives us $8,000 ($40,000/5).

How to Calculate Accounting Rate of Return?

If you have already studied other capital budgeting methods (net present value method, internal rate of return method and payback method), you may have noticed that all these methods focus on cash flows. But accounting rate of return (ARR) method uses expected net operating income to be generated by the investment proposal rather than focusing on cash flows to evaluate an investment proposal. Kings & Queens started a new project where they expect incremental annual revenue of 50,000 for the next ten years, and the estimated incremental cost for earning that revenue is 20,000. The initial investment required to be made for this new project is 200,000.

The Accounting Rate of Return (ARR) provides firms with a straight-forward way to evaluate an investment’s profitability over time. A firm understanding of ARR is critical for financial decision-makers as it demonstrates the potential return on investment and is instrumental in strategic planning. Investment evaluation, capital budgeting, and financial analysis are all areas where ARR has a strong foundation. Its adaptability makes it useful for a wide range of applications, including assessing the economic profitability of projects, benchmarking performance, and improving resource allocation. The ARR is the annual percentage return from an investment based on its initial outlay.

Our Team Will Connect You With a Vetted, Trusted Professional

Accounting rate of return is the estimated accounting profit that the company makes from investment or the assets. It is the percentage of average annual profit over the initial investment cost. This method is very useful for project evaluation and decision making while the fund is limited. The company needs to decide whether or not to make a new investment such as purchasing an asset by comparing its cost and profit.

As such, it will reduce the return on an investment or project like any other cost. The P & G company is considering to purchase an equipment costing $45,000 to be used in packing department. The operating expenses of the equipment other than depreciation would be $3,000 per year. Accounting Rate of Return (ARR) is a formula used to calculate the net income expected from an investment or asset compared to the initial cost of investment. Company ABC is planning to purchase new production equipment which cost $ 10M.

For example, if your business needs to decide whether to continue with a particular investment, whether it’s a project or an acquisition, an ARR calculation can help to determine whether going ahead is the right move. If you’re making a long-term investment in an asset or project, it’s important to keep a close eye on your plans and budgets. Accounting Rate of Return (ARR) is one of the best ways to calculate the potential profitability of an investment, making it an effective means of determining which capital asset or long-term project to invest in. Find out everything you need to know about the Accounting Rate of Return formula and how to calculate ARR, right here. The decision rule argues that a firm should choose the project with the highest accounting rate of return when given a choice between several projects to invest in.