Double-Declining Balance Depreciation Method

To qualify for the section 179 deduction, your property must meet all the following requirements. For fees and charges you cannot include in the basis of property, see Real Property in Pub. You make a $20,000 down payment on property and assume the seller’s mortgage of $120,000. Your total cost is $140,000, the cash you paid plus the mortgage you assumed. However, computer software is not a section 197 intangible and can be depreciated, even if acquired in connection with the acquisition of a business, if it meets all of the following tests. A partnership acquiring property from a terminating partnership must determine whether it is related to the terminating partnership immediately before the event causing the termination.

Calculation Example: Declining Balance Depreciation

Enter the basis for depreciation under column (c) in Part III of Form 4562. The following is a list of the nine property classifications under GDS and examples of the types of property included in each class. These property classes are also listed under column michael finkelstein author at the global treasurer (a) in Section B of Part III of Form 4562. For detailed information on property classes, see Appendix B, Table of Class Lives and Recovery Periods, in this publication. The following are examples of some credits and deductions that reduce depreciable basis.

Declining Balance Depreciation Method (How to Calculate)

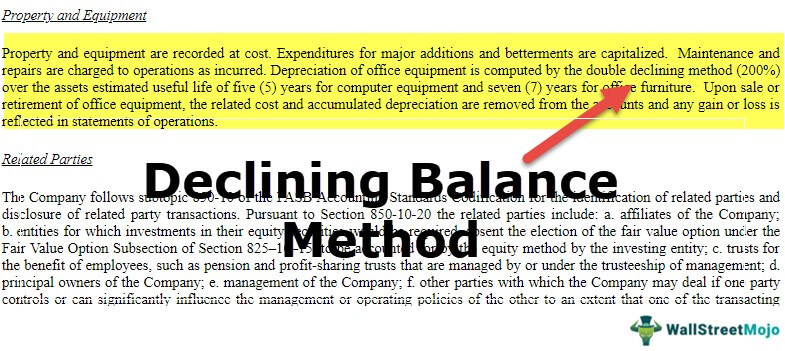

When you dispose of property included in a GAA, the following rules generally apply. You can use either of the following methods to figure the depreciation for years after a short tax year. The DB method provides a larger deduction, so you deduct the $192 figured under the 200% DB method. The DB method provides a larger deduction, so you deduct the $320 figured under the 200% DB method. The DB method provides a larger deduction, so you deduct the $200 figured under the 200% DB method.

Do you already work with a financial advisor?

- Tara is allowed 5 months of depreciation for the short tax year that consists of 10 months.

- The Machine is expected to have a salvage value of $2500 at the end of its useful life.

- For fees and charges you cannot include in the basis of property, see Real Property in Pub.

- Larry uses the inclusion amount worksheet to figure the amount that must be included in income for 2023.

- Whether your tax year is a 12-month or short tax year, you figure the depreciation by determining which recovery years are included in that year.

- The beginning book value is the cost of the fixed asset less any depreciation claimed in prior periods.

The land improvements have a 13-year class life and a 7-year recovery period for GDS. If you only looked at Table B-1, you would select asset class 00.3, Land Improvements, and incorrectly use a recovery period of 15 years for GDS or 20 years for ADS. If you choose, however, you can combine amounts you spent for the use of listed property during a tax year, such as for gasoline or automobile repairs. If you combine these expenses, you do not need to support the business purpose of each expense. Instead, you can divide the expenses based on the total business use of the listed property. The use of property to produce income in a nonbusiness activity (investment use) is not a qualified business use.

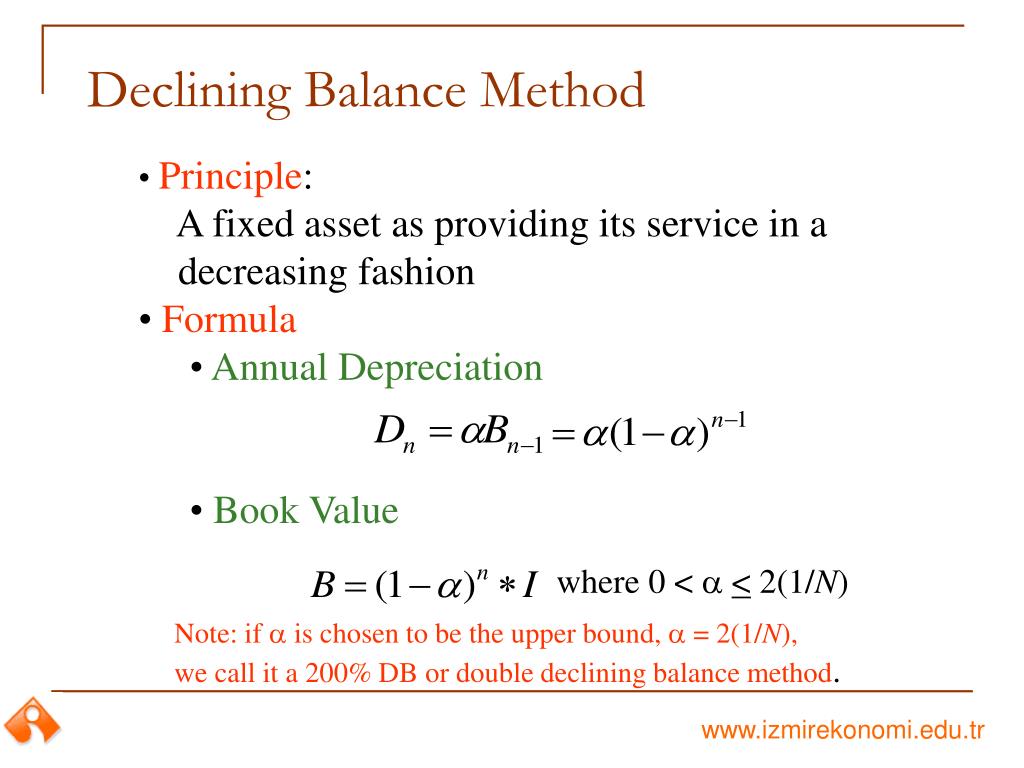

Is double declining balance the same as MACRS?

Computer equipment for instance has better functionality in its early years. Computer equipment also becomes obsolete in a span of few years due to technological developments. Using reducing balance method to depreciate computer equipment would ensure that higher depreciation is charged in the earlier years of its operation. Because twice the straight-line rate is generally used, this method is often referred to as double-declining balance depreciation. They determine the annual charge by multiplying a percentage rate by the book value of the asset (not the depreciable basis) at the beginning of the year. Under the declining balance method, depreciation is charged on the book value of the asset and the amount of depreciation decreases every year.

Start by computing the DDB rate, which remains constant throughout the useful life of the fixed asset. However, depreciation expense in the succeeding years declines because we multiply the DDB rate by the undepreciated basis, or book value, of the asset. It is important to understand that although the charging of depreciation affects the net income (and therefore the amount attributable to shareholders) of a business, it does not involve the movement of cash. No actual cash is put aside, the accumulated depreciation account simply reflects that funds will be needed in the future to replace the fixed assets which are reducing in value due to wear and tear. A way to figure depreciation for property that ratably deducts the same amount for each year in the recovery period.

Don’t post your social security number (SSN) or other confidential information on social media sites. Always protect your identity when using any social networking site. On IRS.gov, you can get up-to-date information on current events and changes in tax law.. Generally, an adequate record of business purpose must be in the form of a written statement.

Go to IRS.gov/WMAR to track the status of Form 1040-X amended returns. Form 9000, Alternative Media Preference, or Form 9000(SP) allows you to elect to receive certain types of written correspondence in the following formats. The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals. The following IRS YouTube channels provide short, informative videos on various tax-related topics in English, Spanish, and ASL. For a business entity that is not a corporation, a 5% owner is any person who owns more than 5% of the capital or profits interest in the business.