First-In First-Out FIFO Method

The inventory record and COGS are updated immediately after the sale, which is the “perpetual” part of the perpetual FIFO method. This approach reflects the natural flow of inventory for many types of businesses, especially those dealing with perishable goods. Moreover, during periods of inflation, using FIFO results in a lower COGS and higher inventory value, which leads to higher net income and taxes compared to other methods like LIFO (Last In, First Out). Since under FIFO method inventory is stated at the latest purchase cost, this will result in valuation of inventory at price that is relatively close to its current market worth. The First In, First Out FIFO method is a standard accounting practice that assumes that assets are sold in the same order they’re bought. All companies are required to use the FIFO method to account for inventory in some jurisdictions but FIFO is a popular standard due to its ease and transparency even where it isn’t mandated.

What Is the Periodic Inventory System?

To determine the cost of ending Inventory, we use a fairly simple formula. Perpetual FIFO is one of the most common cost flow tracking systems in use today, because it accurately reflects the actual flow of goods through a business. Suppose the number of units from the most recent purchase been lower, say 20 units.

The Definitive Guide to Perpetual Inventory

The cost of these 10 items may differ depending on the valuation method chosen. The company’s accounts will better reflect the value of current inventory because the unsold products are also the newest ones. Assume a company purchased 100 items for $10 each and then purchased 100 more items for $15 each. The COGS for each of the 60 items is $10/unit under the FIFO method because the first goods purchased are the first goods sold. Of the 140 remaining items in inventory, the value of 40 items is $10/unit and the value of 100 items is $15/unit because the inventory is assigned the most recent cost under the FIFO method.

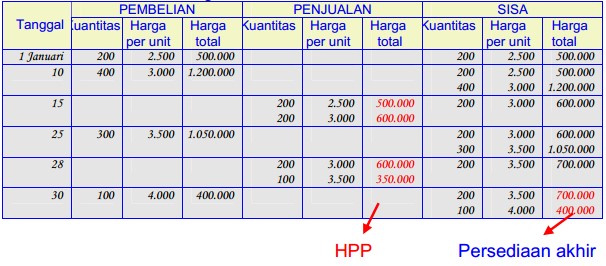

Periodic FIFO Method Example

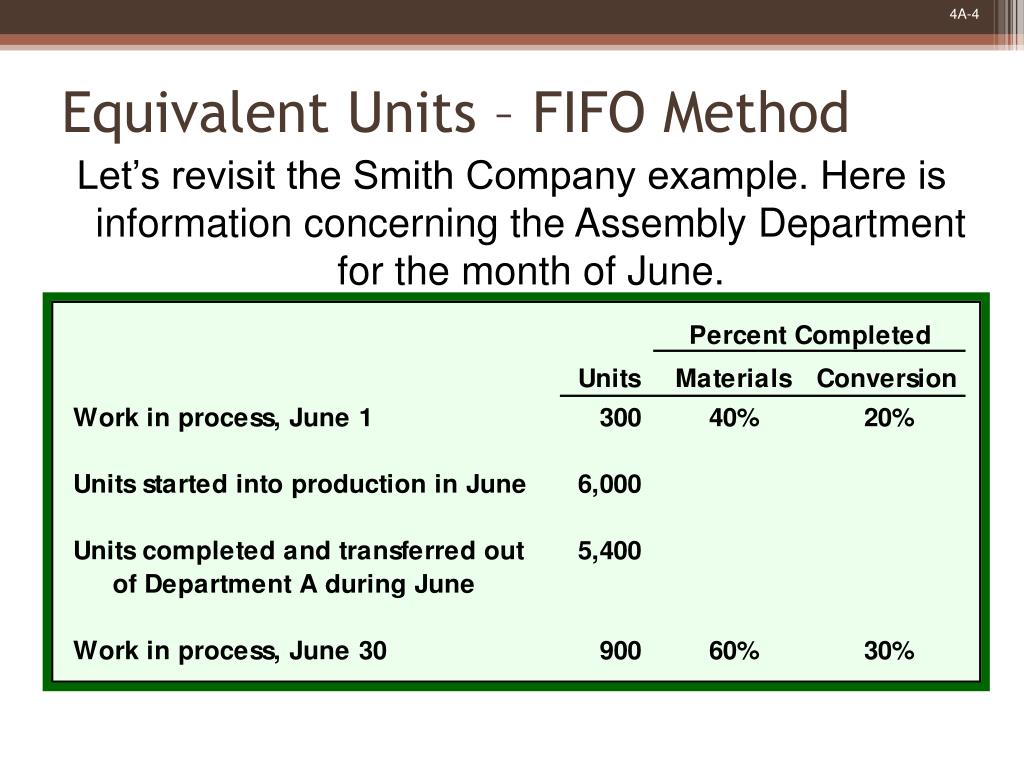

Perpetual FIFO is a cost flow tracking system under which the first unit of inventory acquired is presumed to be the first unit consumed or sold. In addition, this cost flow occurs under a perpetual inventory system, where inventory inflows and outflows are recorded in the inventory records as soon as transactions occur. There is no difference between the resulting charge to the cost of goods sold if a perpetual inventory system or a periodic inventory system is used. When using the perpetual inventory system, the general ledger account Inventory is constantly (or perpetually) changing.

This card has separate columns to record purchases, sales and balance of inventory in both units and dollars. The quantity and dollar information in these columns are updated in real time i.e., after each purchase and each sale. At any point in time, the perpetual inventory card can, therefore, provide information about purchases, cost of sales and the balance in inventory to date. Journal entries are not shown, but the following discussionprovides the information that would be used in recording thenecessary journal entries. Each time a product is sold, a revenueentry would be made to record the sales revenue and thecorresponding accounts receivable or cash from the sale. Perpetual inventory has been seen as the wave of the future formany years.

- Perpetual FIFO is a cost flow tracking system under which the first unit of inventory acquired is presumed to be the first unit consumed or sold.

- The real value of perpetual inventory software comes from its ability to integrate with other business systems.

- Make sure to check out our videos on FIFO inventory calculations video and FIFO inventory journal entries at the end of the post.

- The reverse impact occurs in a deflationary environment (though this is a relatively rare event).

The cost of goods sold would now be $6,625, which is more expensive than it was during the period of rising prices. On the flip side, if prices fall during the year, FIFO will have the lowest ending inventory and the highest cost of goods sold. At the end of the year 2016, the company makes a physical measure of material and finds that 1,700 units of material is on hand. On 31st December 2016, 600 units are on hand according to physical count.

The FIFO method can result in higher income taxes for a company because there’s a wider gap between costs and revenue. The alternate method of LIFO allows companies to list their most recent costs first in jurisdictions that allow it. FIFO assumes that assets with the oldest costs are included in the income statement’s Cost of Goods Sold (COGS).

It breaks down each transaction so you can see and understand precisely how Pinky’s perpetually tracks the inventory. Economic Order Quantity (EOQ) considers how much it costs to store the goods alongside the actual cost of the goods. The results dictate the optimal amount of inventory to buy or make to minimize expenses. Inventory management formulas can tell you when to order more inventory, how much to order, the lead time needed before placing an order and how much stock you require to keep in safety. This system depends on proper inventory control procedures.For example, the system needs to ensure that employees scan in any new inventory promptly.

Ending inventory was made up of 75 units at $27 each,and 210 units at $33 each, for a total FIFO perpetual endinginventory value of $8,955. The three cost flow assumptions that businesses use for this are FIFO, LIFO, and the Weighted Average Cost (WAC). This card shows the starting inventory, sales, purchases, prices and balances. Under a perpetual system, inventory records for this product are continually changing. When the company sells merchandise, the perpetual software records two transactions. First, the software credits the sales account and debits the accounts receivable or cash.

Second, the software debits the COGS for the merchandise and credits the inventory account. In a periodic system, accounting does not perform this second step. Companies using perpetual inventory what is a capital lease versus an operating lease system prepare an inventory card to continuously track the quantity and dollar amount of inventory purchased, sold and in stock. A separate perpetual inventory card is prepared for each inventory item.

Learn more about how you can manage inventory automatically, reduce handling costs and increase cash flow with NetSuite. If Ava needs to raise the product cost to make more profit or lower the cost to make it more competitive in the marketplace, she now knows how it will affect her company’s bottom line. Perpetual inventory allows for more real-time inventory tracking, making it superior to other methods. However, the system requires consistent record-keeping and monitoring and is more expensive to set up than other methods. FIFO Periodic and FIFO Perpetual will ALWAYS result in the same inventory balance! Which is very exciting, because it means that we can take a shortcut in determining our Inventory cost at the end of a period.