How do you record a dividend payment to stockholders?

A stock dividend is when a company issues additional shares of its own stock to its shareholders, usually in proportion to the number of shares they already hold. The value of the dividend is determined by the current market price of the stock. Also, in the journal entry of cash dividends, some companies may use the term “dividends declared” instead of “cash dividends”. However, the cash dividends and the dividends declared accounts are usually the same. And as with debiting the retained earnings account, you’ll credit the total declared dividend value. On the dividend payment date, the cash is paid out to shareholders to settle the liability to them, and the dividends payable account balance returns to zero.

Samsung Boasts a 50-to-1 Stock Split

The company is liable for the dividends and you recognize or record the liability. Most of the time, businesses and business owners aren’t required to issue dividends. If a financial statement date intervenes between the declaration and distribution dates, the Stock Dividend Distributable account should be disclosed as part of Paid-In Capital. The record date is when the shareholder must be on the corporation’s records as owning stock. It is usually two to three weeks after the declaration date, but it comes before the payment date. Given the time involved in compiling the list of stockholders at any one date, the date of record is usually two to three weeks after the declaration date, but it comes before the actual payment date.

- This often occurs when the company has insufficient cash but wants to keep its investors happy.

- When noncumulative preferred stock is outstanding, a dividend omitted or not paid in any one year need not be paid in any future year.

- The journal entry to distribute the soft drinks on January 14 decreases both the Property Dividends Payable account (debit) and the Cash account (credit).

- This records the reduction of the dividends payable account, and the matching reduction in the cash account.

Accounting for Cash Dividends When Only Common Stock Is Issued

They are a distribution of the net income of a company and are not a cost of business operations. Cash dividend is a distribution of earnings by cash to the shareholders of the company. One is on the declaration date of the dividend and another is on the payment date. A cash dividend is a payment made by a company, using its earnings, to its shareholders in the form of cash. Most investors purchase either common or preferred stock with the expectation of receiving cash dividends. Therefore, the dividends payable account – a current liability line item on the balance sheet – is recorded as a credit on the date of approval by the board of directors.

How confident are you in your long term financial plan?

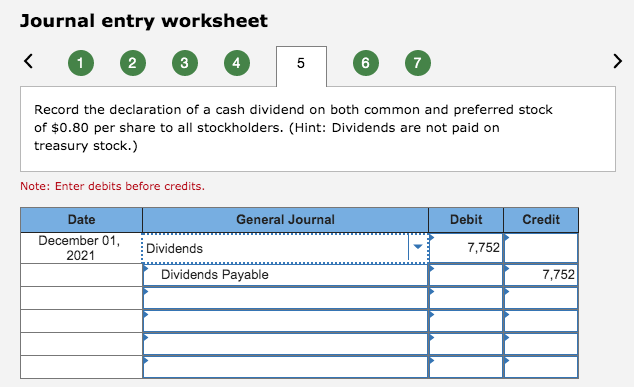

A Stock dividend is a distribution to current shareholders on a proportional basis of the corporation’s own stock. This transaction signifies money that is leaving your company, so we’ll credit or reduce your company’s cash account and debit your dividends payable account. Use the date of the actual payment for the total value of all dividends paid. To record the declaration, how to do a bank reconciliation you’ll debit the retained earnings account — the company’s undistributed accumulated profits for the year or period of several years. Suppose a business had dividends declared of 0.80 per share on 100,000 shares. The total dividends payable liability is now 80,000, and the journal to record the declaration of dividend and the dividends payable would be as follows.

Dividends are typically paid in cash, but they can also be distributed in the form of additional shares of stock or other investments. As the company has declared a 10% stock dividend, it would be accounted just like a cash dividend. Stock dividends (also called bonus shares) refer to issuance of shares of common stock by a company to its existing shareholders in the proportion of their shareholding without any receipt of cash.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

A dividend is a payment of a share of the profits of a corporation to its shareholders. Dividends for a corporation are the equivalent of owners drawings for a non-incorporated business. Dividends declared account is a temporary contra account to retained earnings. The balance in this account will be transferred to retained earnings when the company closes the year-end account.

Depending on your individual circumstances, dividends received may be subject to taxation. It is important to consult with a qualified tax professional for more information about how dividends will affect your personal taxes. The frequency and amount of dividends paid are determined by the company and normally follow regular patterns, such as quarterly or annually. The reduced cost per share will increase the gain or decrease the loss on subsequent sales of the stock. For example, assume that an individual owns 1,000 shares of South Gulf Oil Company. If you don’t need to report in GAAP, you probably have a simpler business structure and fewer shareholders.

To illustrate how these three dates relate to an actual situation, assume the board of directors of the Allen Corporation declared a cash dividend on May 5, (date of declaration). The cash dividend declared is $1.25 per share to stockholders of record on July 1, (date of record), payable on July 10, (date of payment). If the stock dividend declared is more than 20%-25% of the existing common stock, it is considered a large stock dividend and its accounting treatment is more like a stock split. At the time of issuance, the stock dividends distributable are debited and common stock is credited. Large stock dividends do not result in any credit to additional paid-up capital.

Cash dividends are paid out of a company’s retained earnings, the accumulated profits that are kept rather than distributed to shareholders. The treatment as a current liability is because these items represent a board-approved future outflow of cash, i.e. a future payment to shareholders. The carrying value of the account is set equal to the total dividend amount declared to shareholders. Once a proposed cash dividend is approved and declared by the board of directors, a corporation can distribute dividends to its shareholders.